As Mayor, Derek Green supports pragmatic, inclusive tax reforms to make Philadelphia a more attractive and competitive big city. From his time as a small business lender to small business owner, he has learned that City Hall must partner with companies to make doing business easier in Philadelphia – this City needs a tax structure that tells companies: Philadelphia is “open for business.” As City Council’s Finance Chair, he began doing so by authoring and passing the Green Plan, which reduced the wage and business taxes to their lowest levels in decades. He has also introduced legislation on property tax reform that would authorize land value taxation, generating more revenue from vacant-lot land owners. And as Mayor, Derek Green will instruct the Revenue Department to aggressively go after sales taxes that are not being collected. To aid these efforts, he will add staff, modernize infrastructure, and work with the private sector to make it easier to pay taxes and make the City more effective in collecting revenue.

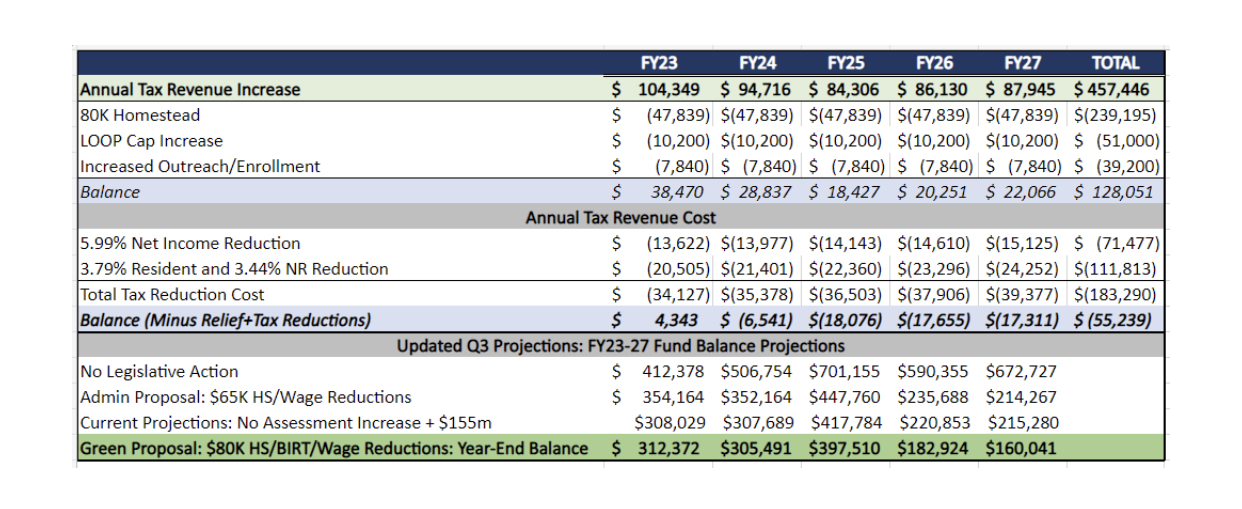

In order to implement these types of reforms, the City needs true leadership. Leadership that was displayed when Derek Green brought independently elected officials together to reduce Wage (resident & non resident) taxes, the Net Income portion of Business Income & Receipts Taxes (BIRT), and the Real Estate tax (via Homestead Exemption increase), while making additional investments for public safety and quality of life improvements and providing a healthy general fund balance. His collaborative approach to getting the Green Plan adopted into the City’s budget is the same strategy that he will use to continue tax reductions over the five-year plan and throughout his Administration.

Tax Reform Principles of a Green Administration

Figure 1: A financial summary of the Green Plan, which helped to pass the FY23 City budget.

Green Plan

Land Value Tax

Sales Tax

© 2023 The Green Fund. All Rights Reserved.